The Bank of England says Bitcoin could become 'worthless'

A hot potato: Bitcoin is by far the most pop and well-known cryptocurrency, merely BTC still has its detractors. Within that category is the Bank of England, which warns that those investing in the crypto should be ready to lose everything as it could at some point become "worthless."

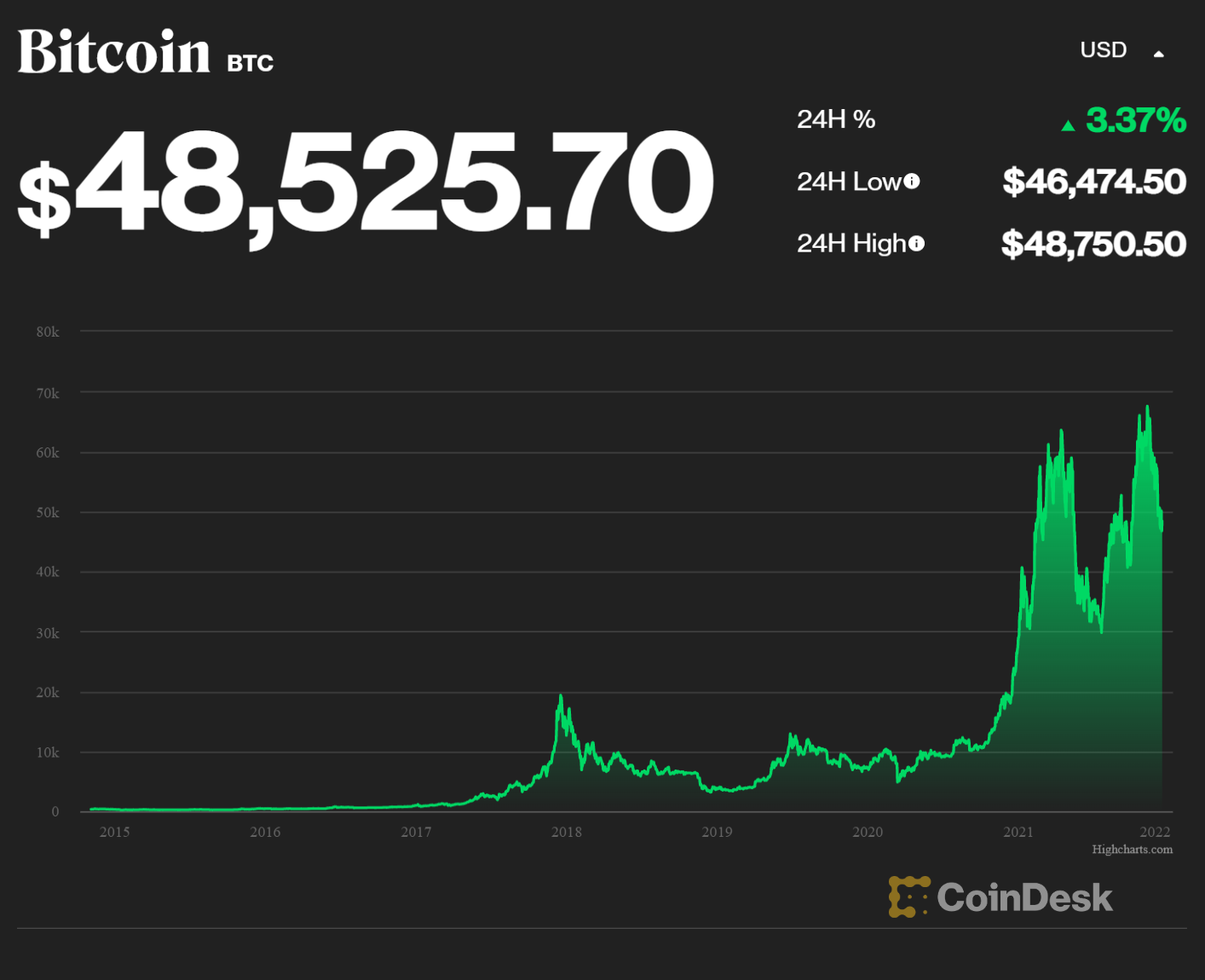

Bitcoin, similar about crypto, often experiences wild toll fluctuations: it has dropped by $20,000 in the concluding month. However, information technology's worth remembering that one Bitcoin at its electric current price of $48,500 is worth almost five times the $x,000 price it sabbatum at just xiv months ago.

Only the Banking concern of England's deputy governor, Sir Jon Cunliffe, has warned of the risks associated with crypto investment. "Their price can vary quite considerably and [bitcoins] could theoretically or practically driblet to zero," he told the BBC.

The Bank said that major institutions should take a cautious approach to adopting crypto assets and that it would pay close attention to developments in the market, writes The Guardian.

"The problem is that, dissimilar traditional forms of money, Bitcoin isn't used to price things other than itself. As Bitcoiners themselves are fond of saying, 'one Bitcoin = one Bitcoin'. Simply a tautology does not a currency make," wrote Thomas Belsham, an employee in the Bank's stakeholder and media engagement segmentation.

Belsham added that the scarcity and express nature of Bitcoin—no more than 21 one thousand thousand Bitcoins can ever be mined—"may even, ultimately, render Bitcoin worthless."

Effectually xviii.9 one thousand thousand Bitcoins, or 90 percent of the full supply, have now been mined, but the network is designed in such a fashion that the last coin won't be mined until 2140. Belsham still warns that sustaining this organisation could become more difficult over time.

"Simple game theory tells us that a process of backward consecration should, actually, at some signal, induce the smart money to get out. And were that to happen, investors really should exist prepared to lose everything. Eventually."

Government agencies' views on Bitcoin and cryptocurrency in general tend to vary from country to country. Sweden has chosen for the whole of Europe to ban crypto mining over environmental concerns, while Mainland china has declared all crypto transactions illegal. El salvador, by dissimilarity, was the first nation to accept Bitcoin equally legal tender and plans to build an entire city based around BTC.

h/t: The Guardian

Source: https://www.techspot.com/news/92639-bank-england-bitcoin-could-become-worthless.html

Posted by: basssignitere.blogspot.com

0 Response to "The Bank of England says Bitcoin could become 'worthless'"

Post a Comment